This article is republished from The Conversation under a Creative Commons license. Read the original article.

Milena Bojovic, Macquarie University

Milena Bojovic, Macquarie UniversityNew Zealand’s dairy sector faces an uncertain future due to several challenges, including water pollution, high emissions, animal welfare concerns and market volatility.

All of these issues are building tensions and changing public perceptions of dairy farming.

In my new research, I argue the time has come for the dairy sector to adopt a “just transition” framework to achieve a fair and more sustainable food future and to navigate the disruptions from alternative protein industries.

The concept of a just transition is typically applied to the energy sector in shifting from fossil fuels to renewable energy sources.

But a growing body of research and advocacy is calling for the same principles to be applied to food systems, especially for shifting away from intensive animal agriculture.

Aotearoa New Zealand’s dairy sector is an exemplary case study for examining the possibilities of a just transition because it is so interconnected in the global production and trade of dairy, with 95% of domestic milk production exported as whole-milk powder to more than 130 countries.

Environmental and economic challenges

New Zealand’s dairy sector faces significant threats. This includes environmental challenges such as alarming levels of nitrate pollution in waterways caused by intensive agriculture.

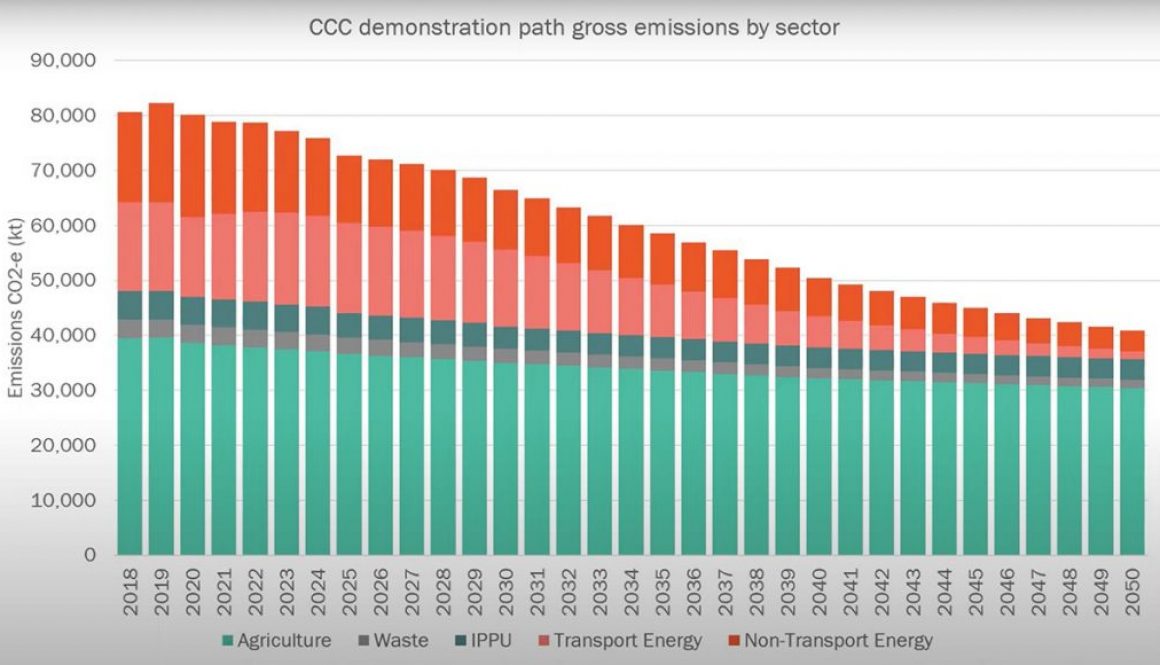

The sector is also a major source of emissions of biogenic methane from the burps of almost six million cows in the national dairy herd.

Debates about how to account for these emissions have gone on for many years in New Zealand. But last month, the coalition government passed legislation to keep agriculture out of the Emissions Trading Scheme.

This means livestock farmers, agricultural processors, fertiliser importers and manufacturers won’t have to pay for on-farm emissions. Instead, the government intends to implement a pricing system outside the Emissions Trading Scheme by 2030. To meet emissions targets, it relies on the development of technologies such as methane inhibitors.

In addition to environmental challenges, global growth and domestic initiatives in the development of alternative dairy products are changing the future of milk production and consumption.

New Zealand dairy giant Fonterra is pursuing the growth of alternative dairy with significant investments in a partnership with Dutch multinational corporation Royal-DSM. This supports precision fermentation start-up Vivici, which already has market-ready products such as whey protein powder and protein water.

Fonterra’s annual report states it anticipates a rise in customer preference towards dairy alternatives (plant-based or precision-fermentation dairy) due to climate-related concerns. The company says these shifting preferences could pose significant business risks for future dairy production if sustainability expectations cannot be met.

Pathways to a just transition for dairy

What happens when one the pillars of the economy becomes a major contributor to environmental degradation and undermines its own sustainability? Nitrate pollution and methane emissions threaten the quality of the land and waterways the dairy sector depends on.

In my recent study which draws on interviews with people across New Zealand’s dairy sector, three key transition pathways are identified, which address future challenges and opportunities.

Deintensification: reducing the number of dairy cows per farm.

Diversification: introducing a broader range of farming practices, landuse options and market opportunities.

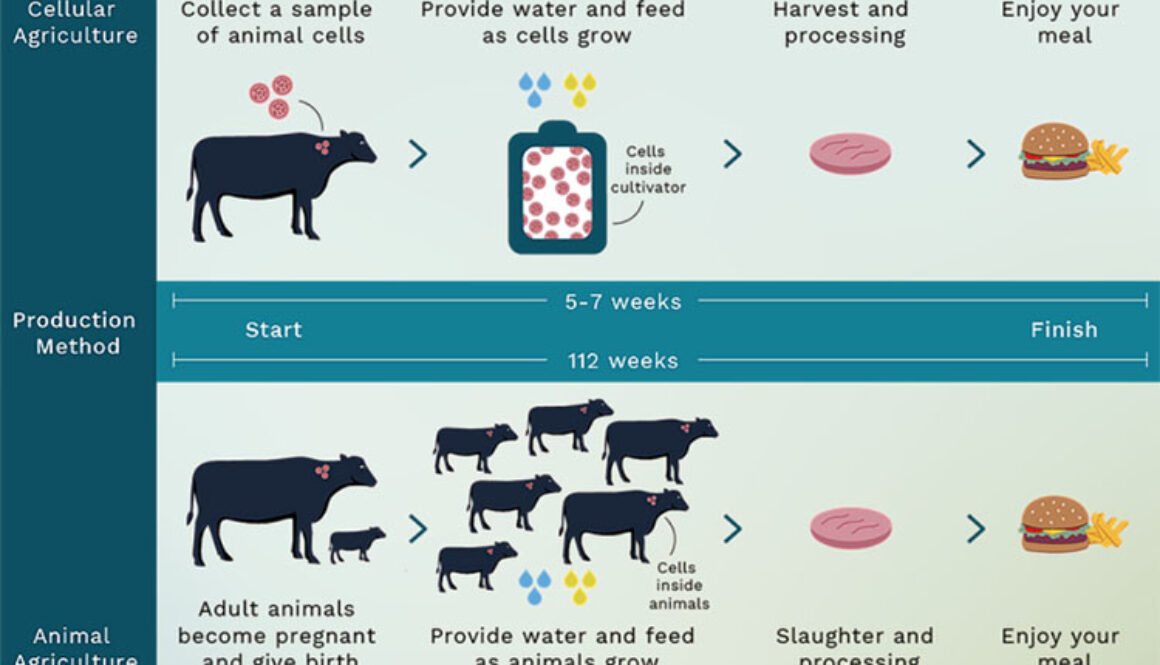

Dairy alternatives: government and industry support to help farmers participate in emerging plant-based and precision-fermentation industries.

While the pathways are not mutually exclusive, they highlight the socioeconomic and environmental implications of rural change which require active participation and engagement between the farming community and policy makers.

The Ministry of Business, Innovation and Employment recently published a guide to just transitions. It maps out general principles such as social justice and job security.

But the guide is light on advice for agricultural transitions. My work puts forward recommendations to shape future policy for a more just and sustainable dairy future. This includes issues such as navigating intensification pressures, supporting the development of alternative proteins and fundamentally supporting farmer agency in the transition process.

For the dairy transition to be fair and sustainable, we need buy-in from leadership and support from government, the dairy sector and the emerging alternative dairy industry to help primary producers and rural communities. This needs to be specific to different regions and farming methods.

The future of New Zealand’s dairy industry depends on its ability to adapt. Climate adaptation demands balancing social license, sustainable practices and disruptions from novel protein technologies.

Milena Bojovic, PhD Candidate, Macquarie University

This article is republished from The Conversation under a Creative Commons license. Read the original article.